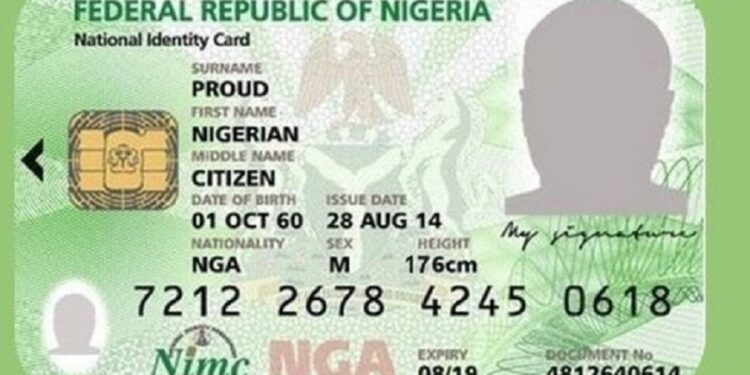

The Federal Government unveiled a bold credit directly to their National Identification Number (NIN). The shift will drive a new centralized credit tracking system, elevate financial responsibility and penalize defaulters.

Speaking at a State House press briefing in Abuja, Uzoma Nwagba, Managing Director of the Nigerian Consumer Credit Corporation (CREDICORP), said the government will link all loan activity to borrowers’ NINs. Financial institutions across the country must now report credit behavior to a centralised national credit bureau.

He emphasized, “Your NIN becomes your financial anchor”, and warned that defaulters will lose access to key services like passport and driver’s licence renewal, mortgages, tenancy agreements, and other formal services. “There will be no hiding place,” he said.

Why The Reform Matters

Nigeria faces a massive credit gap. Financial experts estimate it at about ₦183 trillion (around US $118 billion), exceeding the country’s annual GDP. Many Nigerians fall through the cracks excluded from formal lending systems, despite significant financial potential.

The NIN-linked system aims to shed light on informal and untracked borrowing. By creating traceable credit histories, the government hopes to broaden access to financial services and raise confidence among lenders. A reliable credit system could spark inclusive economic growth.

Balancing Accountability And Inclusion

CREDICORP frames the policy as a tool for promoting discipline rewarding consistent repayment and targeting chronic defaulters without unfair penalties. The policy incorporates both financial and non-financial data to build sophisticated credit scores.

Nwagba linked the reform to President Tinubu’s Renewed Hope Agenda: improving living standards, combating corruption, and stimulating industry. He said, “When people have access to credit, they face less pressure to engage in unethical practices,” highlighting the scheme’s social impact.

YouthCred And Supporting Young Borrowers

As part of this rollout, CREDICORP launched YouthCred a structured credit initiative targeting NYSC members and broader youth aged 18-35. The programme supports financial empowerment and aims to build long-term credit discipline among young Nigerians. It already partners with bank and fintechs and it disbursed over 100,000 loans within six months of launch.

Final Word

This “No NIN, No Credit” initiative signals a decisive transformation in Nigeria’s financial landscape. By leveraging the NIN system to underpin credit reporting, the FG aims to formalize lending, reduce default rates, and improve financial inclusion.

Still, success hinges on implementation ensuring data privacy, safeguarding rights and extending benefits to underserved populations. If executed strategically, this policy could drive Nigeria towards a future of inclusive economic growth.

READ MORE:

Fincra Secures South African Payment Licence to Expand Pan-African Reach